par Paul Ven 16 Aoû 2019 - 17:55

par Paul Ven 16 Aoû 2019 - 17:55

Tout juste quand ça commençait à se replacer pour GE (la maison mère), un analyste financier sort un rapport dénonçant des irrégularités comptables de 38 milliards $...

https://www.bostonglobe.com/business/2019/08/15/fraud-investigator-tangles-with-sending-its-stock-downward/BHD5qjHiCkGOCaXWUQrIgI/story.html

le rapport peut être téléchargé ici: https://www.gefraud.com/

Ça ne sent vraiment pas bon.

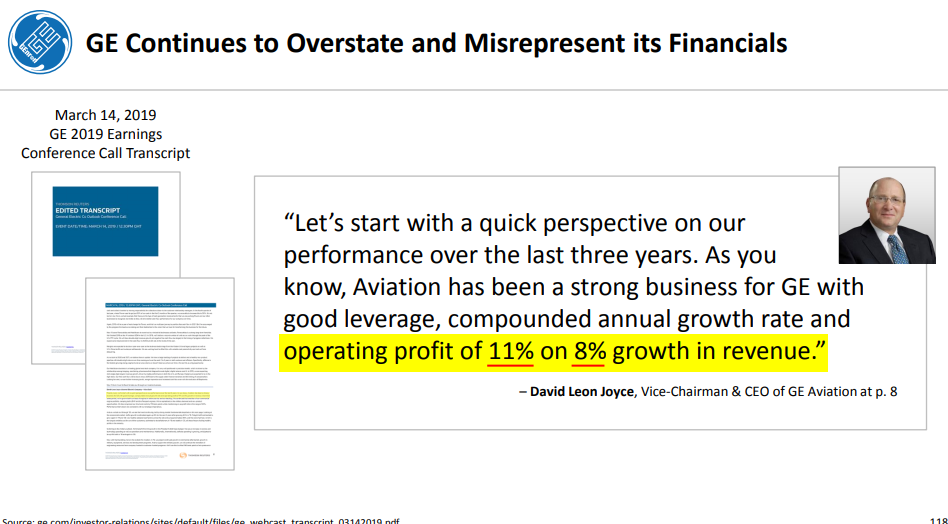

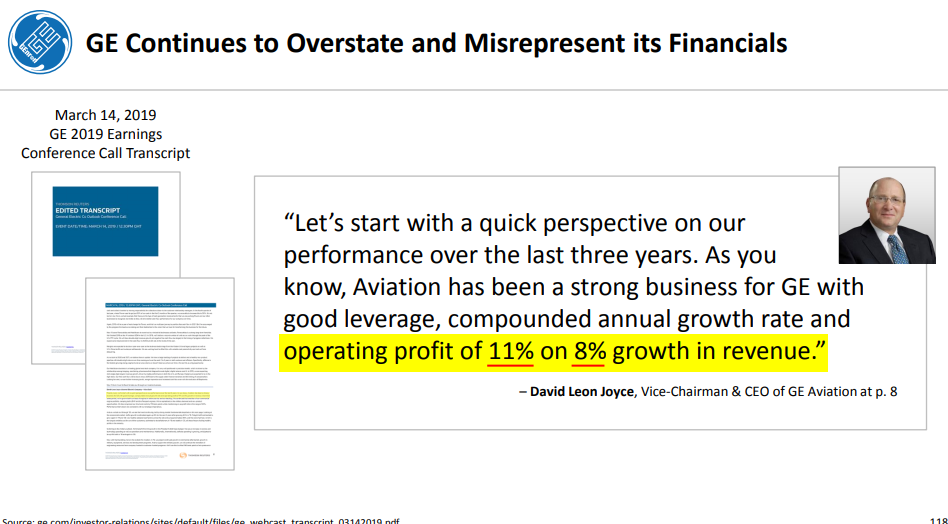

un extrait de la partie qui concerne GE Aviation:

Other companies competing with GE, or in the case of Safran, GE’s 50/50 joint-venture partner at jet engine manufacturer CFM, would report its expenses, R&D costs, tax credits, etc., while GE, for the same joint-venture would only report the top and bottom lines. What was most interesting here was that Safran acknowledged in their 2017 Registration Document (p. 50) that they were losing money on each LEAP engine produced and only hoped to cover their Cost of Goods Sold (COGS) by the end of the decade. So, if LEAP engines were over 51% of CFM’s jet engine sales in 2018, and they didn’t even cover the COGS on each engine sold, how did GE Aviation’s free cash flow go up so much in 2018? Two answers come to mind: 1) GE Aviation is using gain on sale accounting using some sort of mark-to-model basis and/or 2) GE is fabricating its numbers.

Dernière édition par Paul le Ven 16 Aoû 2019 - 18:12, édité 2 fois