Je pensais qu'il y avait déjà un fil pour ça

Enfin si doublon il y a on mettra à jour

Un pièce du WSJ

http://online.wsj.com/article/SB10001424052702303649504577494862829051078.html?mod=WSJ_hps_MIDDLE_Video_Third

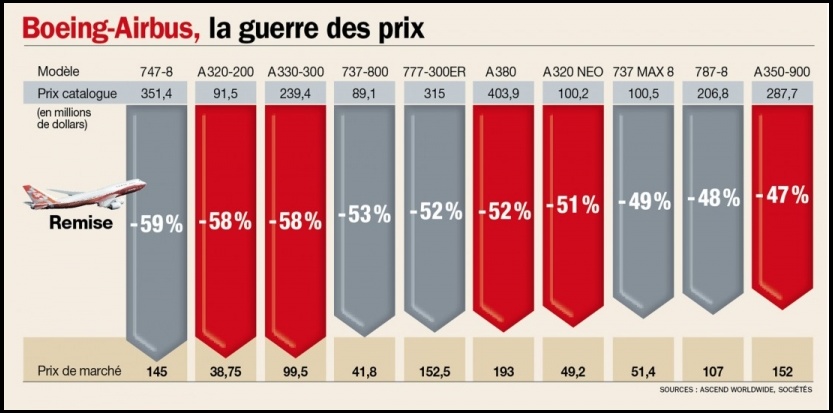

Quelques remises

Boeing 45-50% de remise

Airbus 55-60% de remise

A priori l'intérêt des prix catalogues c'est qu'ils définissent les paiements à l'avancement

Intéressant

Un extrait

Enfin si doublon il y a on mettra à jour

Un pièce du WSJ

http://online.wsj.com/article/SB10001424052702303649504577494862829051078.html?mod=WSJ_hps_MIDDLE_Video_Third

Quelques remises

Boeing 45-50% de remise

Airbus 55-60% de remise

A priori l'intérêt des prix catalogues c'est qu'ils définissent les paiements à l'avancement

Intéressant

Un extrait

However divorced from reality catalog prices are, they do have some uses. One is marketing.

"The list price enables the manufacturers to have large, splashy headlines about the size of the deals they're doing," says Gary Liebowitz, an analyst at the Wells Fargo Securities unit of Wells Fargo & Co.

Published prices also are the basis for the progress payments plane buyers fork over as a plane is being built, Mr. Liebowitz notes. Higher list prices mean bigger deposits.

As for actual prices, airlines occasionally let numbers slip, either because of disclosure requirements or loose tongues.

Southwest Airlines Co., LUV +1.31% for example, recently published numbers related to its new order for Boeing 737 Max jetliners in a government filing. Mr. Liebowitz of Wells Fargo crunched the data and estimated an actual base price of roughly $35 million per plane, or a discount of around 64%. He noted that Southwest is one of Boeing's best customers and that early buyers of new models get preferential pricing. A Southwest spokeswoman declined to comment.

Air India, in seeking funding last year for seven Boeing 787 Dreamliners it expects to receive this year, cited an average "net cost" of about $110 million per plane. The current list price is roughly $194 million, suggesting a 43% discount. Air India didn't respond to a request for comment for this article.

In March 2011, Russian flag carrier Aeroflot mentioned in a securities filing that it would pay at most $1.16 billion for eight Boeing 777s, which at the time represented a discount of 47%. Company representatives at the time said they had no details of the deal.

A senior Thai Airways International official was widely quoted in 2007 as saying the state-owned carrier had received discounts on Airbus A330 aircraft amounting to roughly 50%. A Thai Airways spokeswoman declined to comment on airplane pricing for this article.

Smaller price cuts have been reported for some other airlines. Biman Bangladesh Airlines in 2008 ordered Boeing 777s and 787s at prices cited by the national news agency representing discounts of between 20% and 33%. Biman didn't respond to a request for comment for this article.

Other hints can be gleaned from information Boeing makes public. Each year the manufacturer publishes the contracted value of its order backlog. Separately, it lists the planes in its backlog and their catalog prices. Crunching all these numbers yields an average discount over recent years of about 45%.

Two decades ago, discounts were just a few percent, say industry old-timers. The widening gap points to an unspoken dynamic in jetliner pricing: Plane makers regularly raise their catalog prices and airlines continually bargain those prices down. As a result, actual prices for popular models have barely budged in years, say insiders. Assuming that trend continues, one aspect of airliner pricing looks clear: Discounts will keep growing.